How and why to keep a budget

Since 2017, I have been keeping a family budget: I record and track all income and expenses. Let me tell you how I came to do it, what it does for me and how you can start doing it regularly too.

Backstory

This may sound strange, but the first time I thought about the need to keep a budget was not to check expenses but to answer the simple question: “How much money do we have now?

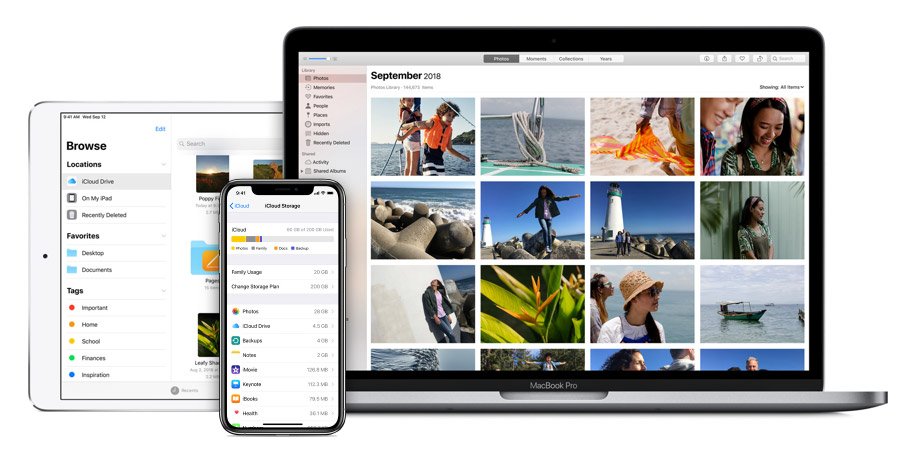

At the time, I was living in Israel, but I was still doing business with Moscow. In the Russian bank, I had a personal account, a savings account, a sole-trader account, and a credit card. In the Israeli bank, I had a personal account and a family account. I also had accounts at PayPal and Yandex-money, which were popular then. My wife had almost all of the same. And we also had some cash in rubles, shekels, and foreign currency left over from trips abroad.

At the same time, there was some small movement of money in all the accounts because of various automatic payments paid from those accounts. For example, I paid my utility bills with an Israeli card, I paid for my website hosting with Yandex-money, and I paid for Soundcloud via PayPal.

It was real chaos, and I’m not exaggerating when I say that I didn’t know how much money I had at a given time. So at first, I just wrote down all the accounts I had, and then I decided to track all the income and expenses to keep those accounts’ balances up to date.

Benefits

When you have all your income and expenses written down, you have an objective picture of your financial situation and can make better decisions.

For example, it may seem that you spend a lot on Uber, so you need a car. But if you write down your expenses, you may find that you spend just £70 per month on taxis, which is a few times less than the cost of owning your own car, let alone the initial cost of buying one.

Or it might seem like you only have Netflix and Spotify subscriptions, for example, for £15 per month. But if you write down all expenses, you may find that you have more subscriptions, including annual ones, so realistically all the subscription services cost you an average of £100 per month.

What to do with this information is up to you. The main thing is that you will be able to rely on real figures rather than guesswork.

Having such an objective picture has helped me plan my future better and make bolder decisions. I feel more in control of my own life, and that’s worth a lot.

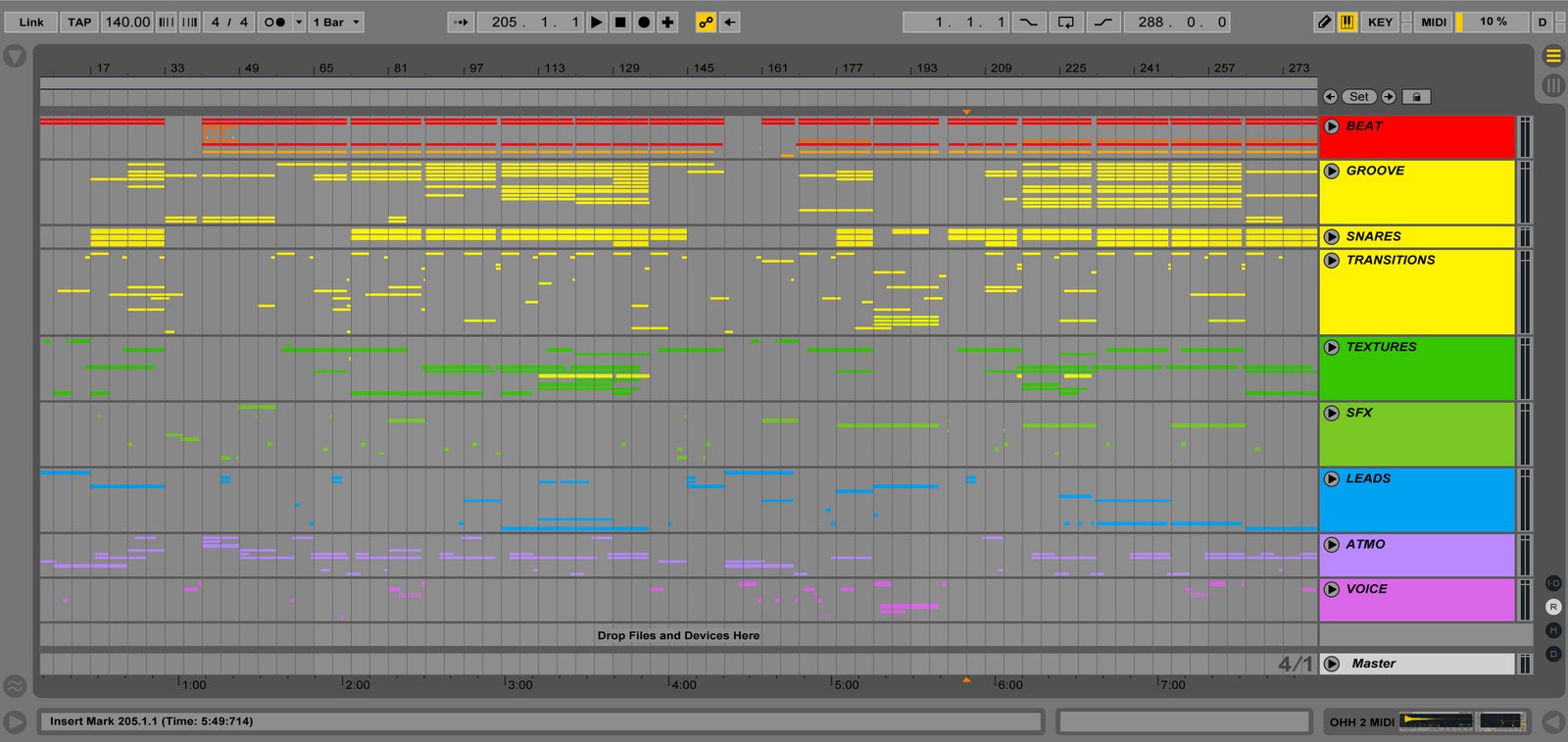

It is also fascinating to record not only expenses but also different categories of income: for example, I now know precisely how much I earn from my music without any illusions.

Tips

Not everyone needs or wants to keep a budget. If the very thought of having to write down every expense terrifies you, there is nothing wrong with you. Many people prefer to go with the flow and not think about such things, which is perfectly normal.

However, if you want to take more financial control of your life and start budgeting, here is my advice:

- Keep a budget in a separate app. Many banks’ apps have learned to categorise expenses and make nice graphs, but I recommend a separate app. It is important that you can add different accounts to it (for example, an account from another bank or a PayPal account, if you have one) and set up your own categories of expenses and income to make it more personal.

- Find an app that works for you. I know how important this is: I’ve started and quit five times just because an app was uncomfortable or unappealing. This is very subjective, so I’m not specifically naming the app I use – just google it and try different options.

- Keep records without tension. This is a very important point because as soon as there is tension, some minimal friction, you immediately want to quit. If you get resistance, it may be worth trying a different app – see the previous point.

- Write everything down. This is crucial. If the data in your app no longer reflect reality, it will all become meaningless. That is why I recommend writing down all incomes and expenditures, even the smallest ones. It takes me about half an hour a week, and so as not to forget, I have created a recurring to-do in my to-do list.

I would be glad if anyone finds my experience useful.